simple backtest

Numpy Simple Backtest

Numpyを使ったバックテスト

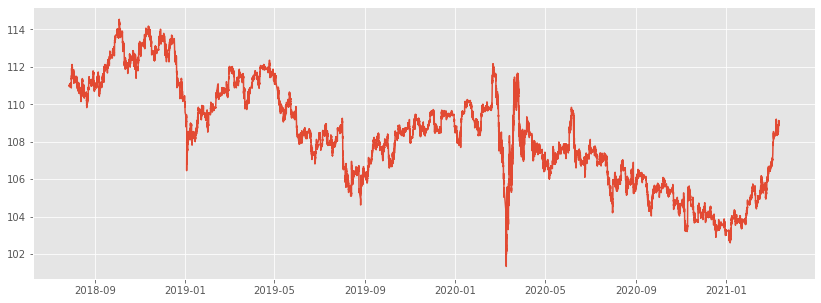

Numpy OHLCデータの読み込みとグラフ描画

(MT4 保存 15分足)

# numpy等のインポート -------------------------------------------------------- import numpy as np import time import datetime # matplotlibのインポートと設定 --------------------------------------------- import matplotlib.pyplot as plt from pylab import rcParams # matplotlibの設定 rcParams['figure.figsize'] = 14,5 # 図のサイズ設定 plt.style.use('ggplot') # 色スタイル設定 # csvデータの読み込み ------------------------------------------------------ """ [['2018.07.20' '21:30' '111.477' '111.518' '111.462' '111.467' '827'] ['2018.07.20' '21:45' '111.467' '111.479' '111.381' '111.444' '470'] ['2018.07.22' '22:00' '111.364' '111.432' '111.363' '111.419' '107']] """ data = np.loadtxt("USDJPY15.csv",delimiter=",", dtype='str') # 文字列として読み込み # 文字列データの日付datetimeへの変換と、float数値への変換 data = [[ datetime.datetime.fromisoformat("-".join((i[0]+" "+i[1]).split("."))) , float(i[2]), float(i[3]), float(i[4]), float(i[5]), float(i[6])] for i in data] #data = [i for i in data if i[0] > datetime.datetime.fromisoformat('2019-01-01 00:00') ] # Close価格のグラフ化 ------------------------------------------------------ x = [i[0] for i in data] y = [i[4] for i in data] plt.plot(x, y) #plt.savefig("figure1.png") plt.show()

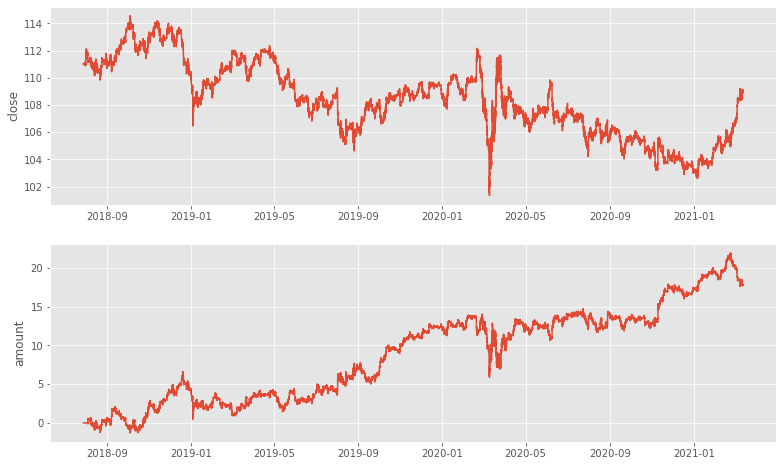

Numpy シンプルバックテスト

# バックテスト ------------------------------------------------------------- lot = 1 # 売買ロット position = 0 # 保有ポジション amount_start = 0 # 初期証拠金 amount = amount_start # 証拠金残高 profit_y = [] # 資産推移 close = np.array([]) # 終値 count = 0 #売買カウント for tick in data: now = tick[0] ltp = tick[4] # last traded price profit_y.append( amount + (position*ltp*lot) ) # 資産推移 close = np.append(close,ltp) close = close[-1000:] if len(close) < 1000: pass smaA = np.mean(close[-1000:]) smaB = np.mean(close[-400:]) if smaA > smaB and position < 1: "BUY" if position < 0: # 保有ポジション決済 amount = amount - ltp*lot position += 1 amount = amount - ltp*lot # 買注文 position += 1 # ポジション保有数 count += 1 elif smaA < smaB and position > -1: "SELL" if position > 0: # 保有ポジション決済 amount = amount + ltp*lot position -= 1 amount = amount + ltp*lot # 売注文 position -= 1 # ポジション保有数 count += 1 amount_all = amount + (position*ltp*lot) # 取引後資産 profit = amount_all - count * lot * 0.012 # スプレッド分差し引き print("取引回数(簡易):", count) print("開始時資産 :",amount_start) print("獲得値幅 :",round(amount_all,5)) print("利益 :",round(profit,5))

取引回数(簡易): 87

開始時資産 : 0

獲得値幅 : 17.799

利益 : 16.755

x = [i[0] for i in data] y = [i[4] for i in data] import matplotlib.pyplot as plt plt.style.use("ggplot") fig = plt.figure(figsize=(13,8)) # Close価格のグラフ化 ------------------------------------------------------ ax1 = fig.add_subplot(211) ax1.set_ylabel("close") ax1.plot(x, y) # 資産変動のグラフ化 ------------------------------------------------------- ax2 = fig.add_subplot(212) ax2.set_ylabel("amount") ax2.plot(x, profit_y) #plt.savefig("figure2.png") plt.show()

Pandas Simple Backtest

Pandasを使ったバックテスト

Pandas OHLCデータの読み込みとグラフ描画

(MT4 保存 15分足)

import pandas as pd import datetime """ # USDJPY15.csv 2018.07.20,21:30,111.477,111.518,111.462,111.467,827 2018.07.20,21:45,111.467,111.479,111.381,111.444,470 2018.07.22,22:00,111.364,111.432,111.363,111.419,107 """ df_ohlc = pd.read_csv("USDJPY15.csv", header=None) df_ohlc[0] = df_ohlc[0] +" "+ df_ohlc[1] df_ohlc[0] = pd.to_datetime(df_ohlc[0]) df_ohlc.columns = ["date","time","open","high","low","close","volume"] df_ohlc.index = df_ohlc["date"] del df_ohlc["time"] del df_ohlc["date"] df_ohlc[["close"]].plot() df_ohlc.head(5)

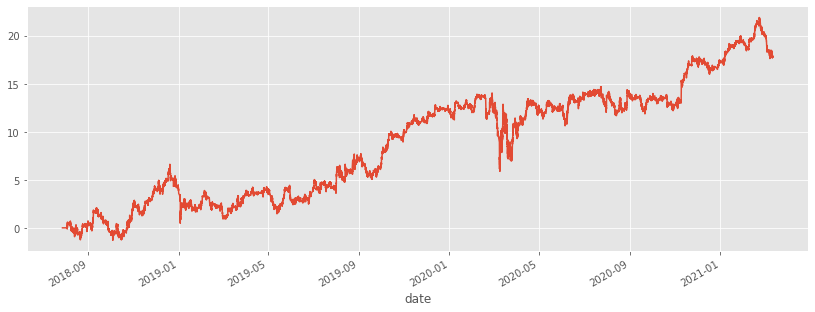

Pandas シンプルバックテスト

Pandasを使ったバックテスト

df = df_ohlc.copy() df = df[datetime.datetime(2018,1,1):] df["smaA"] = df["close"].rolling(window=400,min_periods=1).mean() df["smaB"] = df["close"].rolling(window=1000,min_periods=1).mean() df["signal"] = 0 df.loc[ df["smaA"] < df["smaB"] ,"signal"] = 1 df.loc[ df["smaA"] > df["smaB"] ,"signal"] = -1 count = df['signal'].diff().value_counts() df['returns'] = df['close']-df['close'].shift(1) df['strategy'] = df['returns'] * df['signal'].shift(1) df['strategy'].cumsum().plot() print("取引回数(簡易):",count.sum() - count[0]) v = df['strategy'].cumsum()[-1] print("獲得値幅:",round(v,5)) profit = v - (count.sum() - count[0]) * 0.012 print("手数料差し引き後利益:",round(profit,5))

コードライセンスは CC0 もしくは Unlicense

Creative Commons — CC0 1.0 Universal

Unlicense.org » Unlicense Yourself: Set Your Code Free